Big Oil companies have made billions from exploiting the North Sea’s oil and gas resources. But as it gets harder to squeeze a profit out of the drying fields, they are increasingly asking the taxpayer to fund their polluting activities, all while making billions for their shareholders.

Since 2015, the Treasury has given the industry tax breaks worth £2.3 billion. This is despite BP, Shell and Total making after tax profits of $10 billion in 2016 alone.

The government continues to offer handouts, year after year, to avoid the oil companies packing up and abandoning the North Sea, leaving the communities that have served them for decades reeling in their wake.

At least, that’s what the oil companies want the government to believe.

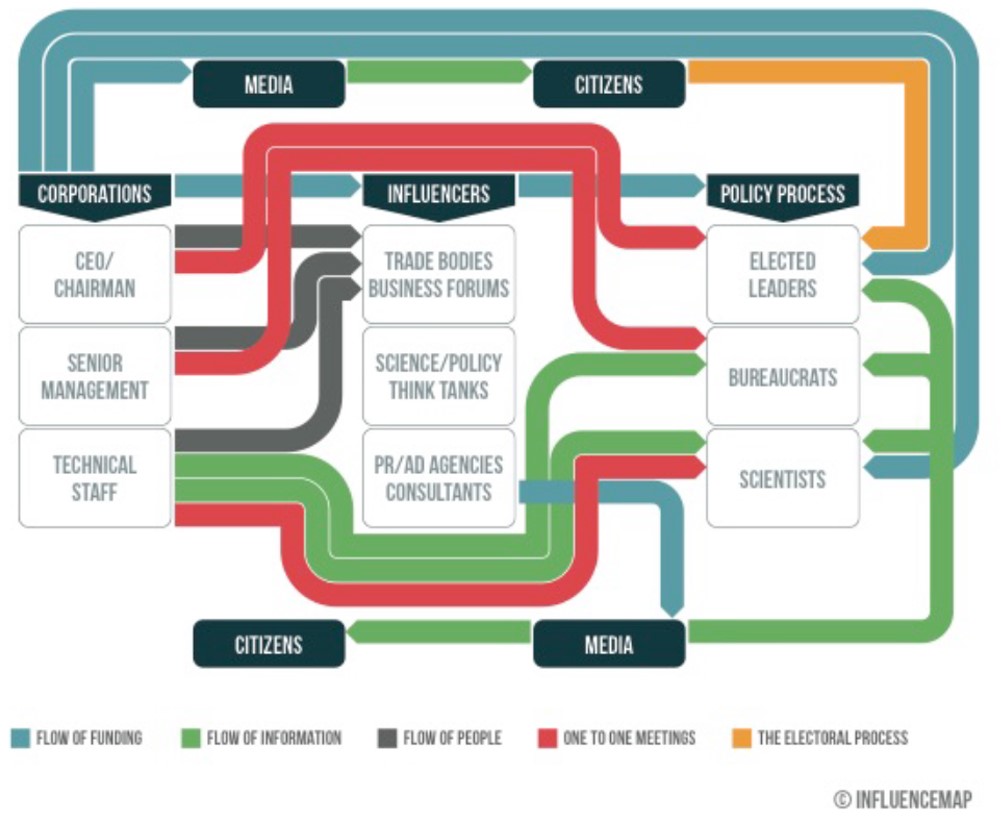

A new report from thinktank InfluenceMap reveals how a network of Big Oil companies, lobbyists and major accounting firms have used the government’s pledge to “maximise economic recovery” of North Sea resources and their direct links to government to secure multi-billion pound handouts that could last for decades.

North Sea Network

Oil and gas exploration in the North Sea has been a staple of British industry for around 60 years. But as the oil starts to run dry, companies are beginning to pack up and leave.

Faced with a potential mass departure, the UK government has become increasingly generous. Since 2015, the Treasury has consistently cut taxes applied to the industry. For instance, in March 2016, the Petroleum Revenue Tax was cut to zero percent, essentially abolishing it.

The Overseas Development Institute (ODI) estimated that the UK government gives a £6 billion per year in subsidies to the fossil fuel sector, with a direct subsidy of £750 million to North Sea companies.

The industry has secured these budgetary treats by persuading the government that the North Sea is a particularly costly environment to operate in, despite historically making larger profits than other UK industries. Companies claim that without the government’s help, they would have to pack up and leave, taking valuable jobs and tax contributions with them.

They have been aided in spreading this message by professional lobbyists and accounting firms that help keep the oil companies firmly in the black, according to InfluenceMap.

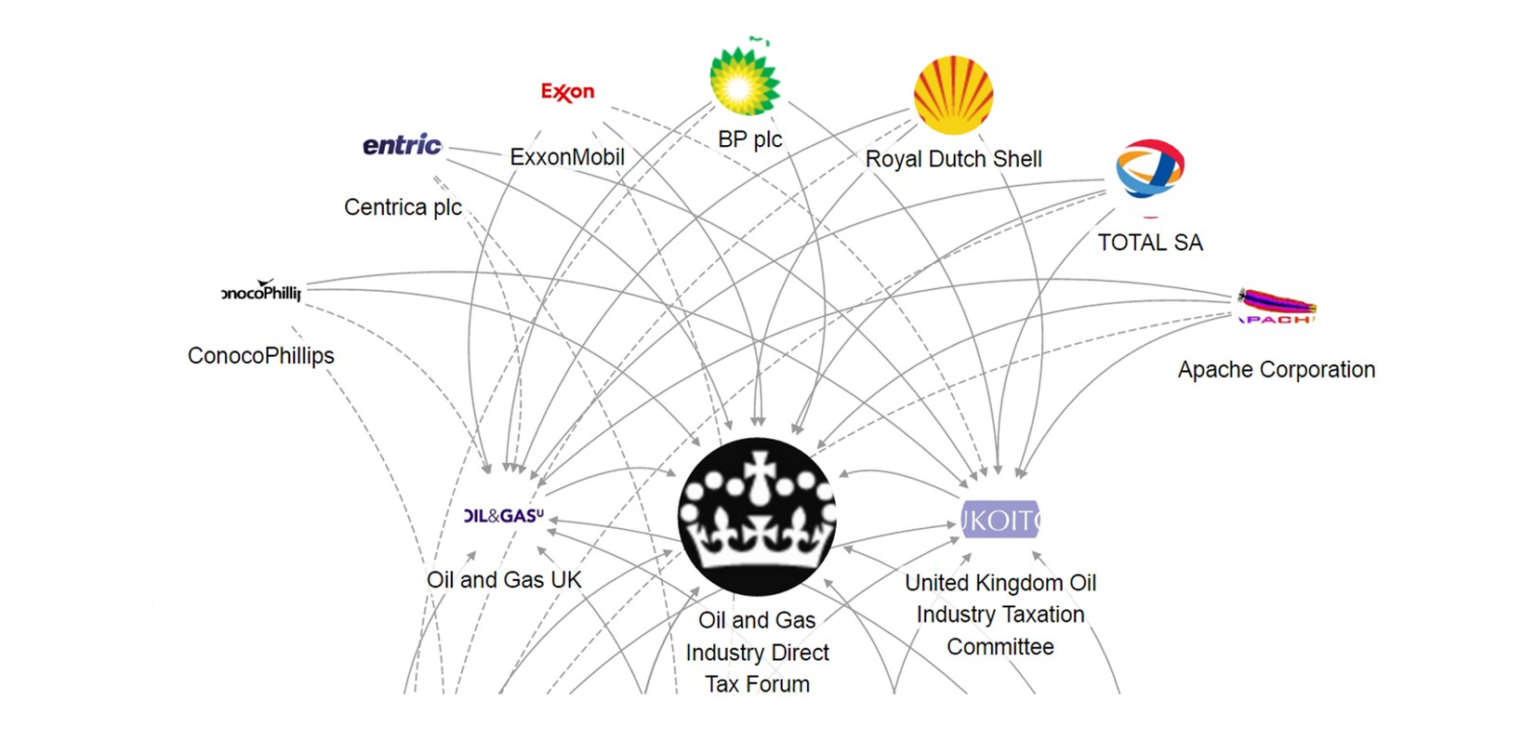

Each of the players has a direct line to government through quarterly meetings of the Treasury-run Oil and Gas Industry Direct Tax Forum. The forum is “made up of oil and gas industry representatives and advisers”, who meet with “representatives from HM Treasury (North Seas Branch, corporate tax team)”.

Industry group Oil and Gas UK (OGUK) has met with ministers at least 49 times in the last 3 years, and spends around £15 million on lobbying each year, InfluenceMap said. OGUK has taken credit for some tax breaks announced in George Osborne’s March 2015 budget.

The United Kingdom Oil Industry Taxation Committee (UKOITC) has also called for tax breaks for the industry, and holds a joint annual conference with the Treasury. It also helps to prepare the agenda for the Oil and Gas Industry Direct Tax Forum meetings.

Both groups are big supporters of cutting oil companies’ taxes.

The trade associations’ lobbying activities are supported by the activities of the Big Four accounting firms (Deloitte, EY, KPMG, and PwC), all of which have professional ties to the Big Oil companies.

EY audits BP, Shell, ConocoPhillips, Apache, and Total on a global basis. PwC audits Centrica, ExxonMobil, and Chevron.

Deloitte worked with George Osborne on a report on the energy industry prior to the first wave of tax breaks being announced, and released a report in 2014 saying tax breaks benefited the industry. KPMG recently released a report on decommissioning strategies for the North Sea industry, and has held joint seminars with OGUK.

All of four firms are on record supporting North Sea oil and gas tax breaks. All four firms are members of OGUK and UKOITC.

All of the Big Oil and Big Four companies regularly attend the quarterly Oil and Gas Industry Direct Tax Forum meetings.

EY tells DeSmog UK that it participates “in a number of industry groups, such as Oil & Gas UK, where we can add value to the discussion and where our services are called upon”

“EY strives to have an open and constructive relationship with regulatory authorities and government bodies worldwide. We support improving certainty and transparency in the regulatory system and compliance with it. All of our services undergo considerable scrutiny to confirm they are consistent with applicable rules”, it said.

These players have helped spread a narrative that the North Sea industry is expensive for the companies, and that they are essentially doing the UK a favour by continuing to operate.

This favour quickly turns into the basis for demands that the government pays them to stay, with the Big Oil network quick to point to job losses and economic upheaval that could occur if the industry packs up and leaves.

InfluenceMap described this narrative as “demonstrably untrue”.

Research by Oil Change International showed tax breaks do not guarantee jobs, as government handouts don’t necessarily make thier way down the chain to workers.

And because the government is spending billions squeezing every last drop of oil out of the North Sea, it can’t spend that money supporting low carbon energy industries — so oil industry tax breaks may even be costing jobs elsewhere.

In recent years, the North Sea industry has also become a burden on taxpayers, rather than contributing to the overall economy, as the network claims. In 2016, the Treasury spent £24 million more propping up the industry than it got in return through tax contributions.

UKOITC and all the energy companies mapped above did not respond to DeSmog UK’s request for comment. OGUK declined the opportunity to comment.

Conflict of Interest

At the same time as helping Big Oil peddle a pro-subsidy narrative, the Big Four accounting firms have also helped boost industry profits, InfluenceMap suggested.

Many companies involved in the North Sea have been accused of tax avoidance.

BP and four of its main subsidiaries and Shell did not pay any corporation tax in the UK in 2014, according to a Sunday Times investigation.

Chevron has £32 billion in offshore accounts according to the International Transport Workers Federation. In 2013/14, consumers paid six times more tax on petrol than the oil and gas industry paid on all taxes on North Sea oil production, it claimed.

The House of Commons Public Accounts Committee has criticised the Big Four for helping multinational companies exploit tax loopholes.

EY told DeSmog UK that its clients “including those operating in the oil and gas industry” seek the companies advice “on a wide range of issues, including how to comply with the applicable tax laws and rules”.

PwC told DeSmog UK that it “has a professional and constructive dialogue with Government and industry bodies. We have strict processes in place to avoid conflicts of interest and comply fully with the relevant UK, European and international rules and regulations”.

“Our people operate under clear principles, set out in our professional code of conduct. Our tax advice is likewise governed by our tax code of conduct”.

The situation raises serious questions about whether the accounting firms have a conflict of interest in advising the government on North Sea oil and gas tax policy, while at the same time being employed by Big Oil for audit and accountancy services, InfluenceMap said.

Decommissioning Cost

The situation is likely to get worse in the coming years, as oilfields start to run dry and the cost of packing up the industry becomes apparent.

Consultancy Wood Mackenzie has previously estimated that North Sea companies will spend £53 billion from 2017 decommissioning oil and gas infrastructure. The taxpayer could end up shouldering about £24 billion of this, through yet more tax relief schemes offered by the Treasury.

Earlier this month, Shell submitted plans to abandon the famous Brent oil field. It estimated that dismantling its four platforms, co-owned by ExxonMobil subsidiary Esso, could take around 10 years, and come with 800,000 tonnes of carbon dioxide emissions.

That costly future could explain why the Big Oil network has been busy lobbying chancellor Philip Hammond for yet more tax breaks in this year’s spring budget, due on March 8.

While the headline tax rates are likely to remain the same, the government may choose to reform particular taxes, and make further concessions to companies that are looking to decommission their North Sea assets, InfluenceMap said.

So while Big Oil has almost drilled the North Sea dry, a network of companies, lobbyists, and accountants are now looking to wring every last drop out of the UK’s increasingly generous fossil fuel subsidy schemes as the industry prepares to abandon the oilfields for good.

Main image credit: DeSmog UK CC BY–SA

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts